News about the Real Estate Market Is Hurting Your Business (But You Can Use It to Your Advantage)

It’s almost impossible to avoid being exposed to news nowadays. Besides being on TV and radio 24/7, people get notifications on their cell phones, in

For many college grads, student loan debt can feel staggering. Six figures of debt isn’t unusual, and on paper, it can make buying a home seem like a pipe dream.

But that mountain of debt doesn’t automatically put you at a disadvantage. In fact, if you’re in certain professions, you might actually be in a better position than you realize.

That’s because some careers come with access to special mortgage programs designed to account for future earning potential, career stability, and the kind of risk that lenders are willing to bet on. These aren’t well-publicized secrets—but they’re out there, and they can make a big difference.

So if you’re carrying a diploma in one hand and a student loan balance in the other, don’t assume homeownership is off the table. Depending on your profession, you may be eligible for surprisingly flexible mortgage terms—sometimes with low (or no) down payments, no PMI, and a more forgiving look at your debt-to-income ratio.

Let’s take a look at a few of the professions that can often unlock these behind-the-scenes benefits:

You’ve spent years in school, endured sleepless nights on call, and probably racked up a small mountain of student debt in the process. But mortgage lenders know something important about you: all that sacrifice is about to pay off—literally. Physician mortgage loans are designed specifically for high-debt, high-earning medical professionals like you. They don’t just glance at your current balance sheet—they factor in your trajectory.

Depending on the program, you might see:

Law school wasn’t cheap—and whether you went the BigLaw or boutique firm route, your salary might be great, but your student loan burden still looms large. The good news is, some lenders offer professional mortgage programs built with your profession in mind. They know your earning potential is strong, your job prospects are stable, and your risk of default is low. And they’re willing to give you some breathing room because of it.

Depending on the lender, you may be eligible for:

You probably know more about debt ratios and amortization schedules than the average underwriter. But even with all that financial literacy, CPAs can still get tripped up by traditional lending guidelines—especially when student loans are part of the picture. Fortunately, some lenders see your CPA credential as a green flag, and they offer tailored mortgage programs that reflect your earning consistency and financial know-how.

You might find options like:

You’re not just essential to your patients—you’re highly valued in the eyes of some lenders, too. NPs and PAs often qualify for medical professional loan programs that recognize your clinical expertise and steady income, even if student loans still hover overhead. Whether you’re just finishing grad school or several years into practice, you may find mortgage options that cater to your unique career path.

Depending on the program, possible benefits include:

Precision, problem-solving, and long hours—sound familiar? Engineers and architects are known for their analytical minds and dedication to their craft, and some lenders are starting to recognize that this also makes them attractive borrowers. While not every lender has a dedicated mortgage product for your profession, a growing number offer programs that consider your steady career path, advanced degree, and high income potential—even if student loans are still hanging around.

Depending on the lender, you might benefit from:

You care for everyone else’s pets, but who’s looking out for you when it’s time to buy a home? Turns out, quite a few lenders are. Like physicians, veterinarians often carry significant student debt despite high earning potential. Mortgage programs tailored to DVMs understand this, and they’re structured to give you a leg up—whether you’re launching your own practice or signing on with a clinic.

Lenders offering these programs may provide:

The Takeaway:

If you’re in one of these high-skill, high-potential professions and still carrying a heavy load of student debt, don’t assume homeownership is off-limits. Professional mortgage programs are specifically designed to factor in your future—not just your current financial snapshot. They can offer more favorable terms, higher loan amounts, and more forgiving views on student debt than traditional loans.

Reach out to a local real estate agent who can connect you with a lender or mortgage broker who understands these specialized programs and can help you uncover the options available in your area, and help turn your hard-earned degree into the keys to a new home.

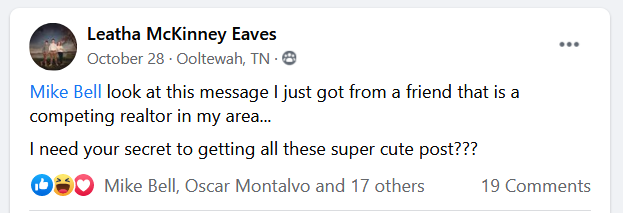

(Shh, our secret)

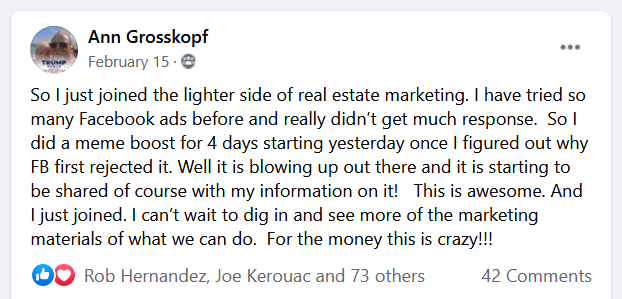

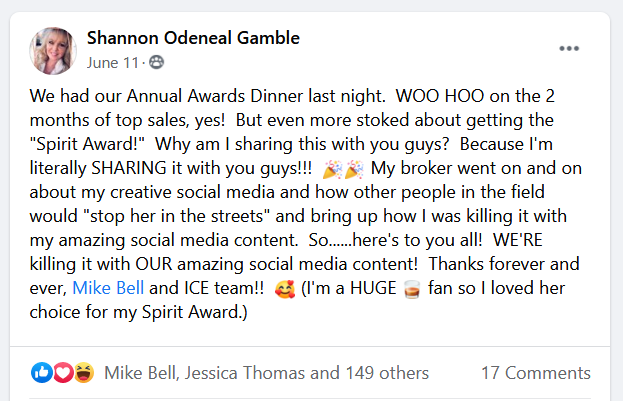

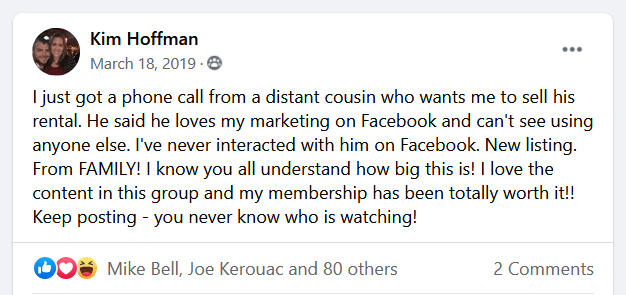

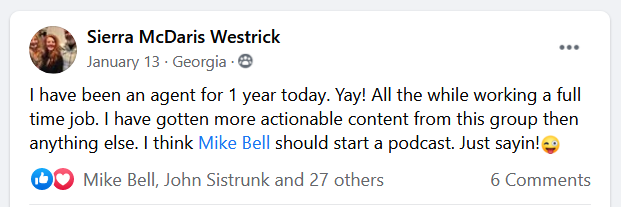

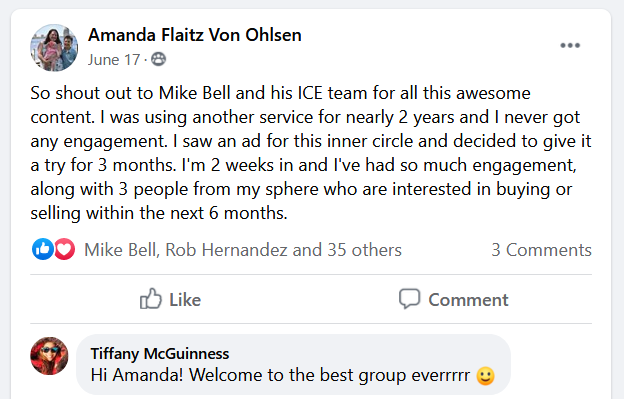

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

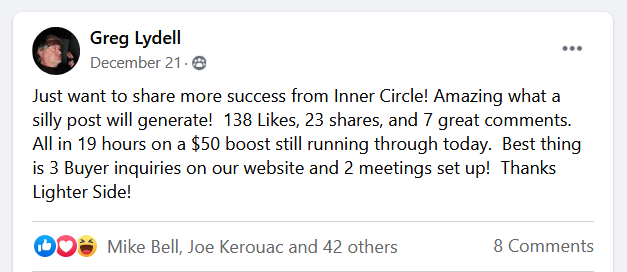

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

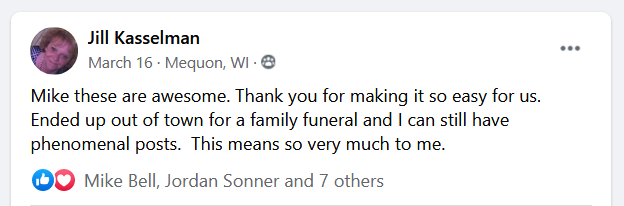

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

It’s almost impossible to avoid being exposed to news nowadays. Besides being on TV and radio 24/7, people get notifications on their cell phones, in

There are some things that you don’t want to learn by mistake. Not that I haven’t made some of these mistakes myself. But if I

“Let me know if you or anyone you know is thinking about buying or selling a house in the near future!” Sound familiar? Even if

Most people looking for info on how to become a real estate agent are just wanting to learn how to get licensed and, ultimately, “hired”

Fair Warning: This story isn’t exactly short. BUT… if you stick with me til the end, AND you’re a real estate agent, you’ll receive a

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.