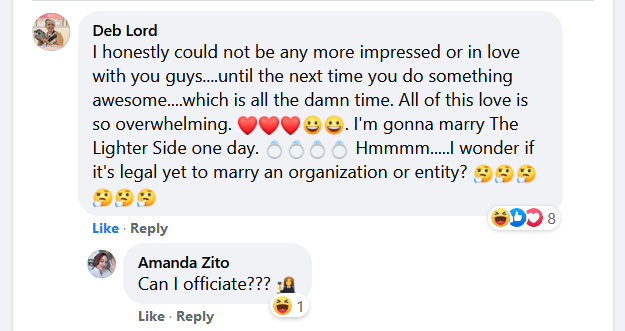

5 Facebook Groups Every Real Estate Agent Should Know About

Oh, how being a real estate agent has changed over the years. It used to be that if you wanted to learn something, get another

If you’re in your 20s or early 30s, buying a home can feel more like a “pipe dream” than the “American Dream,” with prices, rent, food, gas, insurance, and student loans all chewing through every paycheck.

And when advice comes along, it often misses the mark. Being told to skip your daily latte can feel almost insulting when the real obstacles are far bigger and mostly out of your control. Cutting out coffee isn’t what stands between you and homeownership.

That said, something usually has to give. Not because you’re doing anything wrong — but because buying a home has always required trade-offs.

One of the biggest trade-offs facing many younger buyers today isn’t obvious at all. It can feel unavoidable, yet quietly make the difference between feeling stuck and actually moving closer to owning a home.

Weddings have become major financial commitments. A recent CNBC article reported that attending a single wedding — factoring in travel, lodging, outfits, gifts, and pre-wedding events — averages just over $2,000, about as much as a month’s rent in many areas.

And it’s rarely just one.

Many people in their late 20s and early 30s attend multiple weddings each year, sometimes for several years in a row. Add bachelor/bachelorette trips, destination celebrations, and extended weekends, and the costs multiply fast.

These aren’t frivolous expenses. Weddings are joyful milestones — fun, meaningful, and often expected. Saying no can feel uncomfortable, awkward, or disloyal.

That’s what makes them tricky. They quietly drain savings that could go toward a down payment. However, more people are questioning whether there’s a way to participate without sacrificing long-term goals.

A growing trend among younger adults is being upfront about financial boundaries. Called “loud budgeting,” it’s about saying, “I’m saving for a house,” or “That trip isn’t in the cards for me right now.”

Instead of silently overspending, people are turning down social activities for financial reasons, and feeling less pressure to keep up.

Budgeting is reframed not as deprivation, but intention.

One of the best ways to do this is by setting expectations before invitations start rolling in. Letting friends know you’re prioritizing saving for a home can change the tone, open conversations, and sometimes even create solidarity among friends quietly thinking the same thing. Smaller, local gatherings can still be meaningful — and just as memorable — without the same financial weight.

Ideally, friends will understand and support your goals. Often, they do.

But if you encounter judgment or pressure, it’s worth remembering this: people who truly care about you usually want what’s best for you long term. Setting financial boundaries isn’t selfish — it’s responsible.

If homeownership is something you truly want, it helps to make it tangible. Start by doing some rough math. Think about how many weddings, trips, and related events you expect over the next few years. Add up the realistic costs.

Then, talk to a local real estate agent or mortgage professional. Ask what that same amount of money could do for you in today’s market. How much closer would it put you to a down payment? What price range might become realistic? What timeline could make sense?

When you add up how much you could be spending on friends’ weddings over time, it can be eye-opening — and help you make long-term decisions that put homeownership within reach.

The Takeaway:

Buying a home in your 20s or early 30s isn’t easy — the costs are high, the obstacles feel constant, and advice like “skip your latte” barely scratches the surface. The truth is, getting closer to homeownership usually requires trade-offs, and some of them sneak up in ways you might not expect.

Attending weddings and related festivities is one of those expenses. They’re meaningful, joyful, and often feel non-negotiable — yet the costs add up fast. Being upfront about your financial priorities, practicing “loud budgeting,” and setting expectations with friends can make it possible to participate without derailing your long-term goals.

Taking a moment to do the math — tallying the costs of social obligations versus what those dollars could do toward a down payment — can be eye-opening. Pair that with guidance from a local agent or mortgage professional, and suddenly owning a home doesn’t feel like an unreachable dream. It becomes a realistic goal, powered by intentional choices today.

(Shh, our secret)

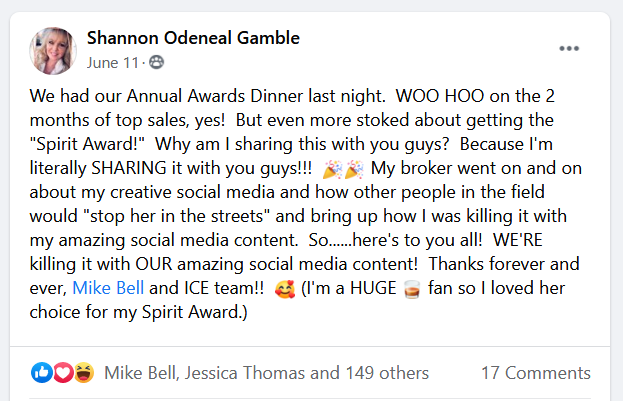

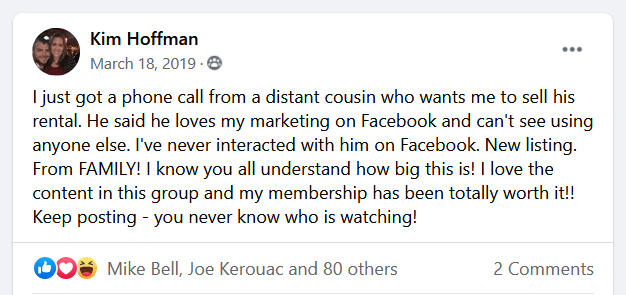

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Oh, how being a real estate agent has changed over the years. It used to be that if you wanted to learn something, get another

You’ve probably been told to build an email database and send them stuff consistently, right? Some agents do. Many don’t. Have you? If you haven’t,

There are some things that you don’t want to learn by mistake. Not that I haven’t made some of these mistakes myself. But if I

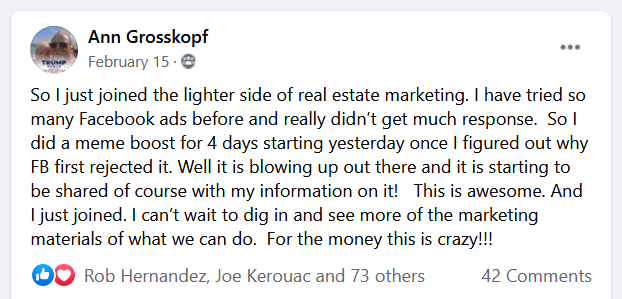

In this spirit of transparency, we admit we’re totally biased when we say “the most clever.” Why’s that? Because we created them. At any rate,

“Normal” people often ask me, “Cathy, could I make it if I’m not genetically predisposed to being a Realtor as you were?” Heredity did play

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.