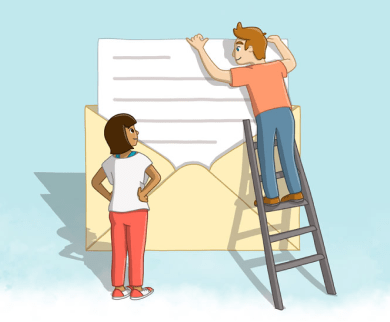

National Days—The Perfect Opportunity for Real Estate Marketing

National Days used to be few and far between and were meant to mark the occasion of something truly special worth celebrating, and a lot

Do you have some loose or missing shingles on your roof? Are your gutters pulling away from the house causing rain to pool at your foundation? Got any annoying leaks in your kitchen or bathroom? Or is there a bit of mold on your bathroom ceiling because of the steam of long hot showers?

If you have any of these, or other things that need to be fixed around your home, you’re not alone. Homeowners often learn to live with certain problems around their house, promising themselves they’ll get around to it eventually, for any number of reasons, such as:

Unfortunately, ignoring smaller issues around your home can snowball into a bigger problem than you might think.

According to Simply Insurance, recent statistics show that over 95% of U.S. homeowners have homeowner’s insurance. This is in part due to the fact that it just makes good sense to protect yourself from large catastrophic losses, but it’s also in large part due to the fact that anyone who has a mortgage is likely required to have homeowner’s insurance by their lender. (In fact, if you don’t maintain payments on your own policy, they’ll buy a policy of their choice and make you pay for it… and it’s usually more expensive than one you would have gotten on your own.)

So, while you might be aware that the longer you ignore problems with your house the more damage can be done, you might be comfortable taking that risk, since you most likely have insurance. Some people might even think that putting it off until it gets even worse and causes major damage could work to their advantage, thinking they can just file an insurance claim and get the work paid for that way!

While it might be appealing to get your money’s worth from your homeowner’s policy, it could easily backfire and cost you more than just taking care of issues before they get worse. Kiplinger recently published an article about how delaying repairs can actually put your homeowner’s insurance policy at risk. Within the article, Beth Riczko, president of Nationwide’s P&C Personal Lines was interviewed and said:

In other words, not only will your insurance not cover the loose roof shingles the homeowner ignored for some time, they won’t cover the damage done to the inside of the house because of it! So the homeowner now has to pay for the roof and all of the interior damage. On top of that, now that the insurance company is aware of the issue, they may demand that you fix the problems immediately, or threaten to cancel your coverage.

So if you notice that work needs to be done around your house, and it’s something your insurance company or their adjuster could reasonably expect that you would have noticed and ignored, you ought to take care of the issue before it becomes a bigger problem. Here are a few tips on how to fix any issues you come across:

The Takeaway:

If you have some minor issues around your house that you’ve been ignoring, make sure to address them as soon as possible. Otherwise, your homeowner’s insurance may not cover any bigger damage that is caused due to you not fixing the smaller issues over time.

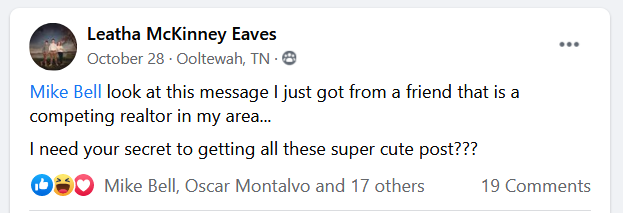

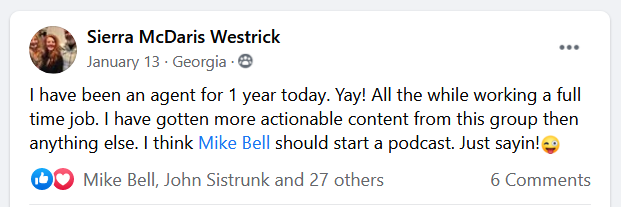

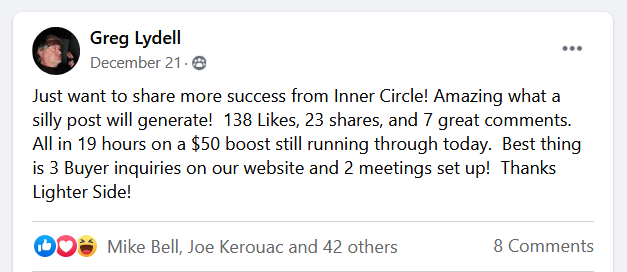

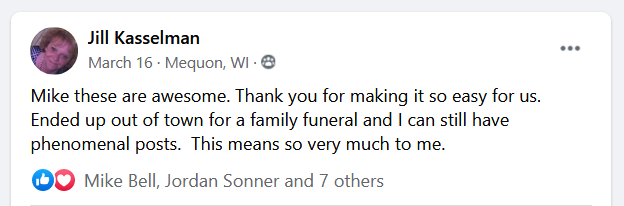

(Shh, our secret)

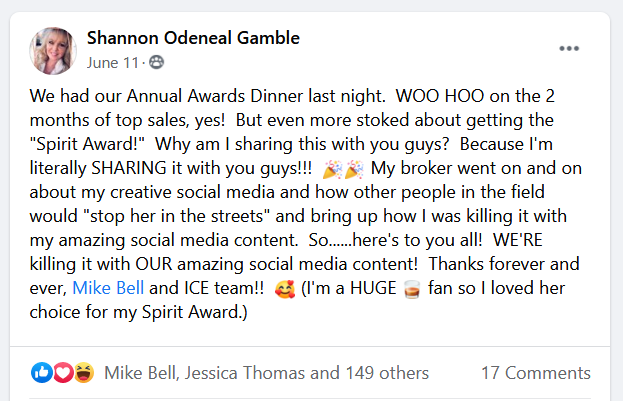

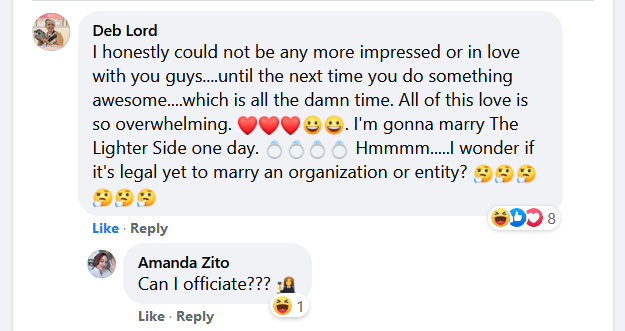

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

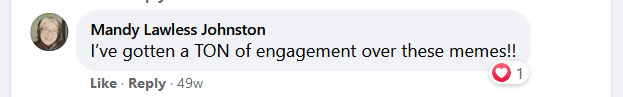

Become the bearer of good vibes!

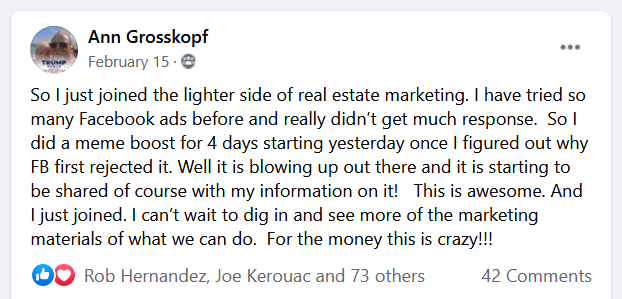

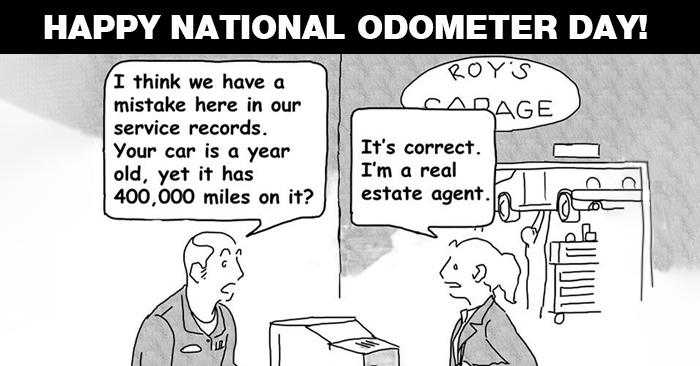

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

National Days used to be few and far between and were meant to mark the occasion of something truly special worth celebrating, and a lot

When you’re in the middle of working with a client, you’re touching base with them constantly. You can actually get pretty close to them, and

We’ve all experienced the stress and tension of moving, right? Even after you’ve done all the footwork to find the perfect place, you’ve still got

Social media made marketing yourself as an agent about as cheap and easy as it comes. Years ago, you had to have a good chunk

Customer Relationship Management (CRM) systems are a necessary evil for real estate agents. Ideally they’ll make your life easier, keep you organized, and help you

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.