Are Facebook Pages “Dead” For Real Estate Agents?

Hey there, Real Estate friend – I know Facebook can really burn your biscuits, but… Don’t throw in the towel just yet. Your business page

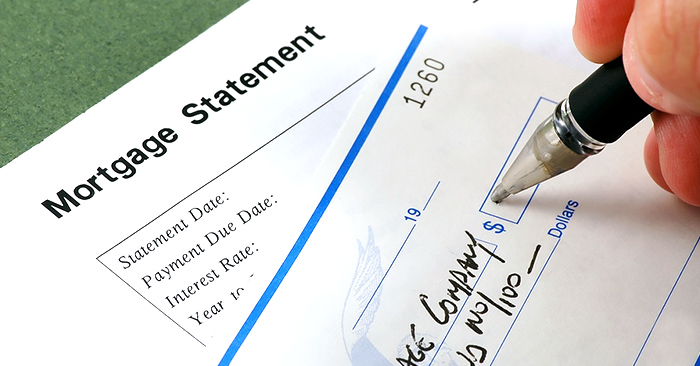

Nobody wants to overpay for a house, and people tend to focus on negotiating as low of a purchase price as possible when they actually buy a house. And of course they want to make sure the interest rate on the mortgage they take at that time is as low as possible too. This all makes total sense to do, of course. But, once all of that is done, many homeowners kind of “set it and forget it”, and never look at whether they could be paying even less for their house once they own it.

According to this CNBC article, Black Knight (a mortgage data provider) says that over 5 million homeowners just missed out on their chance to refinance to a better rate. Rising interest rates have just knocked all of those people out of the running to save some money on their house.

The good news is that according to Black Knight’s analysis and metrics, there are still 5.9 million homeowners who are in a position to save money, despite the rising rates. Their data indicates that more than a million borrowers could save at least $400 per month, and 661,000 homeowners could save more than $500 per month.

So, if you haven’t recently refinanced, you may want to do yourself a favor and look into it. You could be paying more per month for your house than you need to, and ultimately more for your house than you need to. Capitalize on the increased equity you might have due to the sharp rise in home values in the past couple of years, and the still record low mortgage rates, before either shifts too much for it to benefit you.

When doing your research, make sure you consider and analyze the costs of doing the refinance, and that you aren’t getting sold on doing one when it doesn’t actually make sense.

The Takeaway:

Before speaking to a lender, consult with a local real estate agent about the current market value of your house, the lenders will want to know this information. But also speak to the agent about your short and long term goals with the house, as this will affect the advice an agent gives you, and whether or not it makes sense for you to refinance at all. Then you can truly weigh whether the savings are worth doing, given the costs to do so, and your future housing plans.

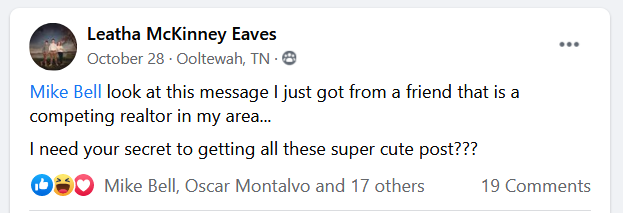

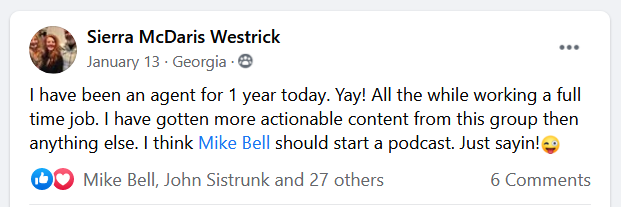

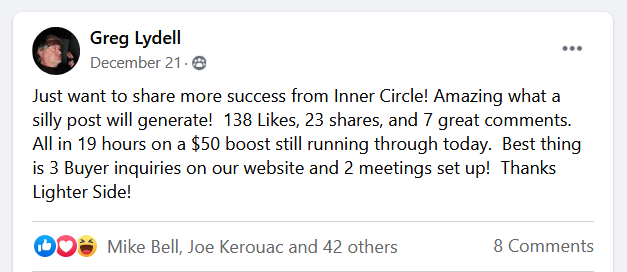

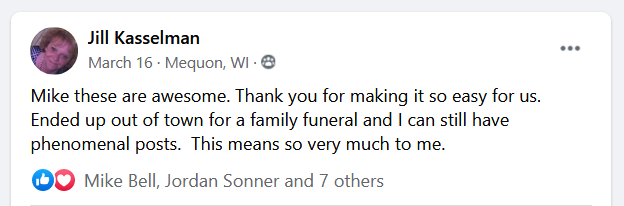

(Shh, our secret)

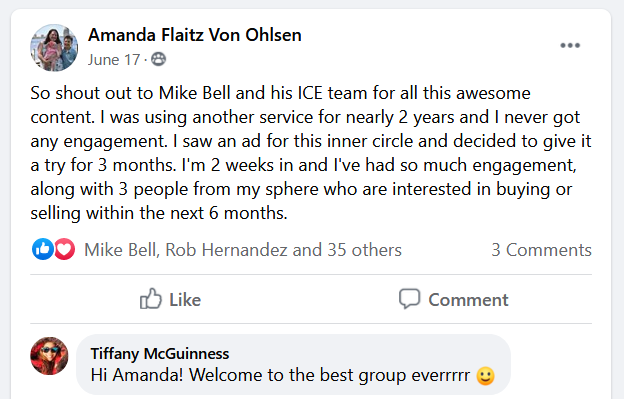

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

Hey there, Real Estate friend – I know Facebook can really burn your biscuits, but… Don’t throw in the towel just yet. Your business page

Oh, how being a real estate agent has changed over the years. It used to be that if you wanted to learn something, get another

This article was published on April 5, 2013 by Amy Curtis and is being republished with her permission. With the spring market underway, my days

Hello dearest real estate friend. Glad you could make it today. What I want to do here is simple – convince you to be yourself.

There’s no way around it… Now, more than ever, you’ve GOT to stand out as a real estate agent. To say our industry is over-saturated

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.