6 Rarely Considered Things You Should Know Before Becoming A Real Estate Agent

If you’re thinking about becoming a real estate agent, you’re probably aware that you don’t make a dime until (and unless) you sell a house.

Almost 25% of Millennials (ages 26-41) claim they plan on renting forever according to this Apartment List article. That’s nearly double the amount since they started their ongoing survey of 31,000 Millennials in 2018.

In the grand scheme of things, 1 in 4 Millennials swearing off homeownership forever isn’t earth-shattering news. To put things in perspective, the highest rate of homeownership ever was 80% in North Dakota back in 1900. But generally speaking, the homeownership rate has hovered in the 65% range nationally for almost 5 decades. Some people will always be renters; homeownership isn’t for everyone.

There are four main reasons they give for not buying:

Obviously, by far the biggest reason is affordability. It’d be easy to chalk that up to the recent surge in home prices and rising interest rates. It’s legitimate and true. But that’s also been the main reason since well before the current market conditions. Truthfully, affordability is almost always the reason renters give for not buying, regardless of the decade. It’s never an easy financial leap to take.

However, while renting may feel like the easier, more affordable option, over time it’s not. In fact, renting is getting even more expensive. According to this Fortune article, an increasing amount of older adults are struggling to be able to pay rent. They’re constantly in fear of rent hikes that may just get to a point they can’t afford to pay. Then what?

While it’s never an easy financial leap to take, once you take the leap, your housing cost can be kept stable for years to come, and even go down as you pay off your house. Sure, it won’t be easy up front, but think of how it’ll be for you a couple of decades from now. Would you rather have an asset you can sell, or still be paying a landlord an ever-increasing amount of rent with nothing to show for it?

Sure, prices and rates may seem high right now, but it almost always feels that way relative to the times. There’s always an area and a house you can afford to buy a house in, if you’re qualified for a mortgage. (And if you’re not, it’s worth making an effort to be qualified!) Your first house may not be everything you want or where you ideally would like to live, but it’s a first step toward taking control of being able to afford to live comfortably as you get older. It may seem years away right now, but time has a way of creeping up on you. And the cost of living does, too…

The Takeaway:

Considering the financial burdens many Millennials have, coupled with rising interest rates and home prices, it’s no surprise that an increasing number of Millennials are saying they’ll never buy a home and remain renters forever.

But if you can afford to rent, the chances are you can afford to buy. It might not be your dream home, or in the exact neighborhood you’d prefer, but you can buy something. Buy where (and what) you can afford now, so that you have a predictable and controllable cost of living — as well as an asset you can sell — as you grow older.

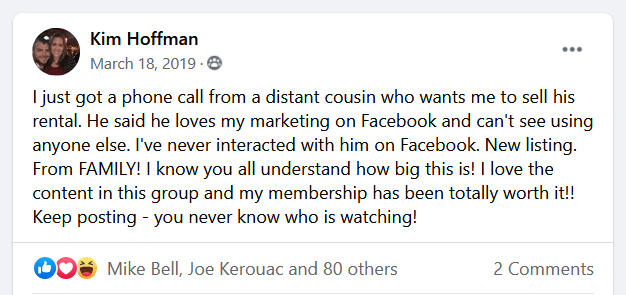

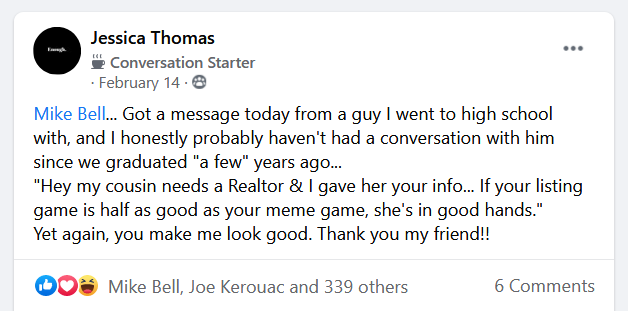

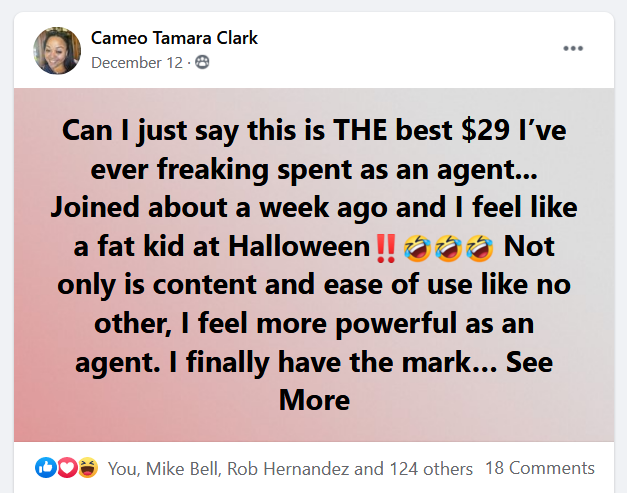

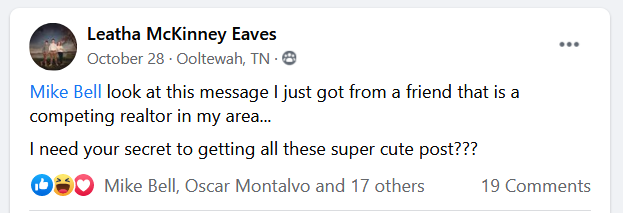

(Shh, our secret)

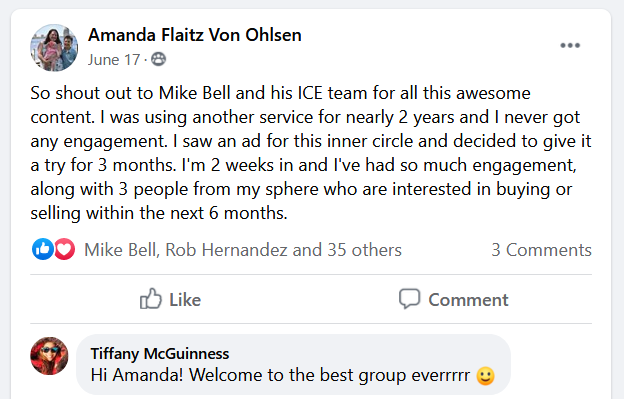

Show your sphere your an expert. We have over 2100 articles covering every real estate topic your audience will love.

Position yourself as a real estate authority!

Real estate + topical events — the perfect match!

Become the bearer of good vibes!

Because hey, everyone loves to laugh!

Get our weekly email that makes communicating with your sphere on social actually enjoyable. Stay informed and entertained, for free.

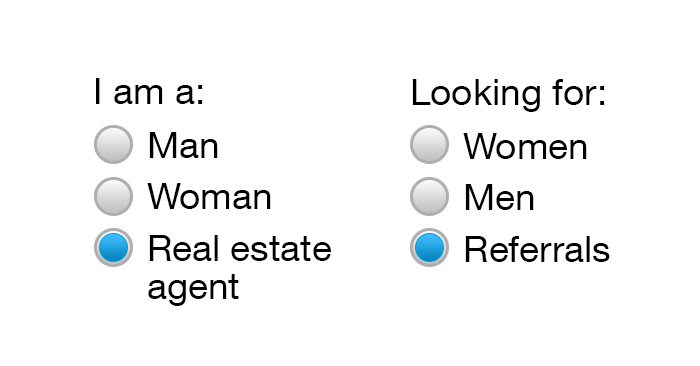

If you’re thinking about becoming a real estate agent, you’re probably aware that you don’t make a dime until (and unless) you sell a house.

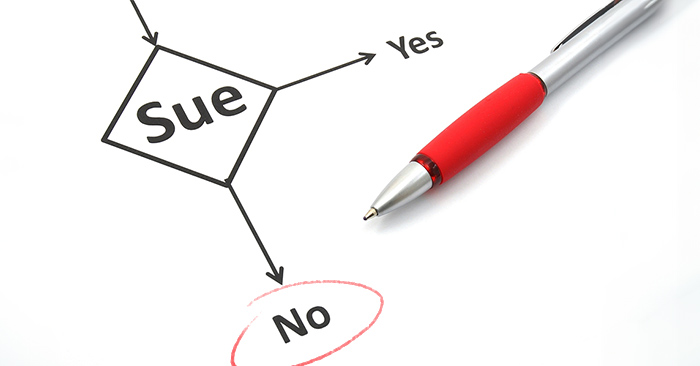

Most real estate agents were shocked enough when they heard that The National Association of Realtors and two brokerage firms were liable for $1.8 billion

Blogging is something many real estate agents struggle with. To begin with, you might wrestle with whether or not it’s even worth doing. Is blogging

Via Big Stock Photo “Home is a shelter from storms—all sorts of storms.” — Political pundit William J. Bennett As I stand at what is probably

Statistically speaking, the majority of real estate agents don’t make it beyond a couple of years, so don’t feel bad if you’re thinking about giving

Depending on your situation, it may not take the full 30 minutes.

This reset password link has expired. Check the latest email sent to you.