Buying a house is never easy for younger generations, no matter what decade it is. Home prices always seem too steep, mortgage rates too high, and their incomes too low to be able to easily buy a house.

However, the current market is possibly the most difficult for younger people to become homeowners, due to home prices, mortgage rates, and tremendous competition to buy the low number of homes for sale. So pointing to the claim that eating an occasional avocado toast (or spending on other minor splurges) is stopping them from becoming a homeowner is kind of tone-deaf.

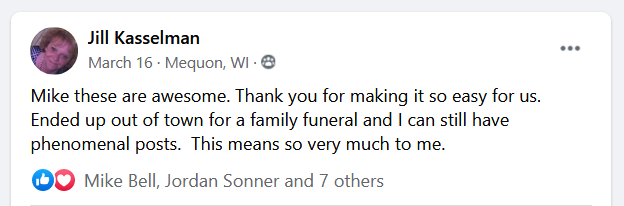

But, you also can’t spend more money than you make on food, drinks, and fun times, and expect to be able to buy a house either. Most people need to make some sacrifices in order to save money and buy a house. But according to this recent Yahoo Finance article, a recent survey revealed that over 80% of Millennials and Gen Z claim they’ve gone into debt… just to hang out with friends who overspend.

The survey — which was conducted by Qualtrics on behalf of Intuit Credit Karma — found that the three largest expenses Millennials and Gen Z spent on in order to hang out with friends, were:

- Going out to eat

- “Nights out” and having drinks

- Taking trips and vacations

The top reasons they gave for spending more money than they have were:

- Not wanting to feel left out

- Wanting to keep up with their friends’ lifestyle

- Wanting to please their friend

- Simply not knowing how to say “no”

Why Bother Sacrificing If It’s So Hard for Millennials and Gen Z to Buy?

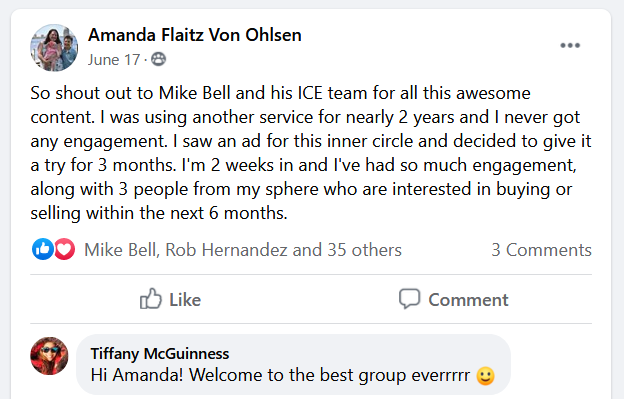

When you hear so many people saying how difficult it is for Millennials and Gen Z to buy a house, it’s easy to give up hope and just spend money on the things that give you some short-term, immediate joy. Why not at least hang out with friends and spend money on food, drinks, and fun?! You’re all in the same boat, right? But that’s not necessarily true…

According to recent data, nearly a third of Millennials and Gen Z own their own homes, so it’s definitely possible to achieve! So what are they doing that the other two thirds of their peers aren’t?

You Don’t Necessarily Have to End Friendships…

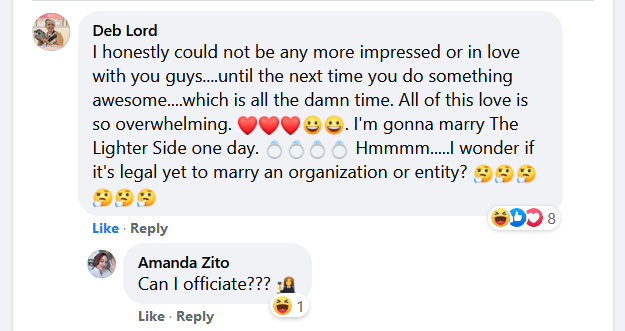

The Qualtrics study mentioned above also found that 47% of Gen Z and 36% of Millennials consider ending friendships due to their friends’ spending habits. While it’s hard to say whether those who say that are the same ones who go on to own a home, it’s interesting that it’s a similar percentage to the number of young people who own their own homes.

Hanging out with like-minded people who have similar goals as you certainly doesn’t hurt. So if you want to buy a home, it might make sense for you to gravitate toward friends that are trying to save money, build good credit, and buy a home.

But it’s also a shame to part ways with friends just because they aren’t necessarily as focused or determined as you to buy a house! You can’t put a price on good friends in life, and everyone is different. So rather than distancing yourself, or completely ending friendships with people who cause you to spend more money than you should, here are a few things you can do:

- Share your hopes of owning a home with them. True friends will support your dreams and try not to get in your way.

- Be a leader and encourage your friends to consider working toward owning one themselves. You might find that they also felt the same way and just needed to hear someone else was focused on doing so!

- That said, homeownership isn’t for everyone, so be respectful of their feelings and don’t make them feel bad for not wanting to own a house… at least yet. If someone doesn’t feel responsible enough and prepared for it, then they should probably just rent or live at home with family until they’re ready.

- Let your friends know you want to hang out, but that you need to be thoughtful about what you do, and how much money you’re spending. Be open about how much you budget for fun times so you can plan on doing things that don’t cost too much.

But if you try all of that and your friends are unreceptive, rude, or try to pressure you to spend carelessly and ignore your goals, then you might try to distance yourself or end the friendship. And always be on the lookout for friends who encourage you and help you achieve your goals, whether they have the same ones or not.

The Takeaway:

A recent survey reveals that over 80% of Millennials and Gen Z have incurred debt to keep up with their friends’ spending habits. Since many younger people feel like homeownership is so out of reach, it’s often easier for them to spend money hanging out with friends, than it is to save money and build their credit in order to buy a house.

If you want to buy a house, be open with your friends about your goals, and establish boundaries and limits on what you can do and how much you can spend when spending time with them. You might just find that they felt the same way, and are glad to have a friend who also wants to watch their spending and save to buy a house!